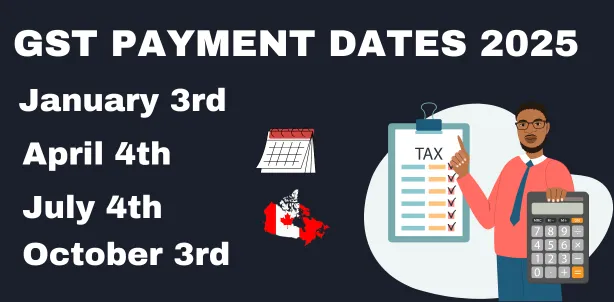

GST Payment Dates 2025

GST payment dates have already been announced for 2025. If you don’t pay the tax on time, interest will be added to the payment. The payment dates are divided quarterly as follows: January 3rd, April 4th, July 4th, and October 3rd.

But in order to manage late payments, due payments, GST/HST Credit eligibility criteria, and credit calculation, you must follow the guidelines to stay safe from interest and penalties by knowing the due dates.

Know Dates

Free from Penalty

Check Criteria

Follow Guidelines

GST payment dates remain the same for the different provinces, such as Ontario, Alberta, and others. The amount of the payments varies for each individual according to their age and marital status. If you’re running a business, it will depend entirely on your annual income.

This relief helps reduce financial stress caused by inflation and rising living costs. The payment dates for this extra relief have not yet been announced by officials, so avoid believing false information about the dates you may see anywhere.

GST Payment Dates 2025: Ontario, Alberta

All Canadian provinces follow the same GST payment dates. The following are the dates and the list of provinces that adhere to GST payment schedules in Canada for 2025 and 2024. Please note that there is a GST break or holiday on certain food items, which means there will be no tax on these items from December 14, 2024, to February 15, 2025.

GST payment and Credit dates for 2025:

- January 3rd

- April 4th

- July 4th

- October 3rd

Remember: The next payment date will fall on October 3

GST payment and Credit dates for 2024:

- January 5, 2024

- April 5, 2024

- July 5, 2024

- October 4, 2024

Note: It’s because October 5th, 2024, fell on a Saturday. This is why the due date for credits and payments had been moved to the previous day, October 4th.

How Much Payment Will Be Received in 2025–2026?

The CRA has announced the latest payments to be credited under the new rules, and the amounts have increased compared to 2024–2025.

- A single individual will receive up to $533.

- A married couple or those with a common-law partner will receive $698.

- Each child under age 19 will receive $184.

GST/HST Extra Payment Increase in 2025

- In 2024–2025, the amount for an individual with net income under $11,337 was $340.

- For 2025–2026, it has increased to $349, a rise of $9 (about 2.7%).

- For couples, the payment increased from $680 to $698.

- For each child, the amount increased from $179 to $184.

How to Calculate Payments in Cases with Children?

If you are a single parent, you will receive $349.

If you live with your spouse or common-law partner, both of you together will receive 2 × $349 = $698.

If you are a single parent with one child, you will receive an additional $349 for your first child.

If you are living with your spouse/partner and have a child, you will receive $184 for each child.

Example: If you are a single parent with three children, you will receive:

- $349 (for yourself)

- $349 (for your first child)

- $184 + $184 (for two additional children)

- Total = $1,250

Eligibility Criteria for July 2025 – June 2026

- You must be a permanent resident of Canada.

- Your annual income must be less than $11,337.

- Payments will be based on your 2024 tax return.

- The amount depends on your adjusted net income in the base year (2024).

- Your marital status affects the amount you can receive.

- Your number of children also determines the payment.

- If you turn 19 in January 2026, you can file your 2024 tax return and receive your first payment in April 2026.

- If you turn 19 after January 2026, you will not be eligible for the January 2026 GST/HST credit.

Payment Chart for July 2025 – June 2026

- The GST/HST credit depends on your marital status, family size, and income.

- The credit for 2024 is paid quarterly: July 2025, October 2025, January 2026, and April 2026.

- Please inform the CRA (Canada Revenue Agency) if your address, family size, or marital status changes.

Single Individual or Single Parent Family

| Adjusted Family Net Income ($) | Credit – No Children ($/year) | Credit – 1 Child ($/year) | Credit – 2 Children ($/year) | Credit – 3 Children ($/year) | Credit – 4 Children ($/year) |

|---|---|---|---|---|---|

| Under $11,337 | $349.00 | $882.00 | $1,066.00 | $1,250.00 | $1,434.00 |

| $12,000 | $362.26 | $882.00 | $1,066.00 | $1,250.00 | $1,434.00 |

| $15,000 | $422.26 | $882.00 | $1,066.00 | $1,250.00 | $1,434.00 |

| $20,000 | $522.26 | $882.00 | $1,066.00 | $1,250.00 | $1,434.00 |

| $25,000 | $533.00 | $882.00 | $1,066.00 | $1,250.00 | $1,434.00 |

| $30,000 | $533.00 | $882.00 | $1,066.00 | $1,250.00 | $1,434.00 |

| $35,000 | $533.00 | $882.00 | $1,066.00 | $1,250.00 | $1,434.00 |

| $40,000 | $533.00 | $882.00 | $1,066.00 | $1,250.00 | $1,434.00 |

| $45,000 | $533.00 | $882.00 | $1,066.00 | $1,250.00 | $1,434.00 |

| $50,000 | $309.05 | $658.05 | $842.05 | $1,026.05 | $1,210.05 |

| $55,000 | $59.05 | $408.05 | $592.05 | $776.05 | $960.05 |

| $60,000 | $0.00 | $158.05 | $342.05 | $526.05 | $710.05 |

| $65,000 | $0.00 | $0.00 | $92.05 | $276.05 | $460.05 |

| $70,000 | $0.00 | $0.00 | $0.00 | $26.05 | $201.05 |

| $75,000 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

Married or Common-law Family

| Adjusted Family Net Income ($) | Credit – No Children ($/year) | Credit – 1 Child ($/year) | Credit – 2 Children ($/year) | Credit – 3 Children ($/year) | Credit – 4 Children ($/year) |

|---|---|---|---|---|---|

| Under $45,521 | $698.00 | $882.00 | $1,066.00 | $1,250.00 | $1,434.00 |

| $46,000 | $674.05 | $858.05 | $1,042.05 | $1,226.05 | $1,410.05 |

| $50,000 | $474.05 | $658.05 | $842.05 | $1,026.05 | $1,210.05 |

| $55,000 | $224.05 | $408.05 | $592.05 | $776.05 | $960.05 |

| $60,000 | $0.00 | $158.05 | $342.05 | $526.05 | $710.05 |

| $65,000 | $0.00 | $0.00 | $92.05 | $276.05 | $460.05 |

| $70,000 | $0.00 | $0.00 | $0.00 | $26.05 | $210.05 |

| $75,000 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 |

Other Benefit Payment Dates

Here are the important benefit payment dates from the Government of Canada for eligible Canadians. These benefits include the following:

Canada child benefit (CCB)

- December 13, 2024

- January 20, 2025

- February 20, 2025

- March 20, 2025

- April 17, 2025

- May 20, 2025

- June 20, 2025

- July 18, 2025

- August 20, 2025

- September 19, 2025

- October 20, 2025

- November 20, 2025

- December 12, 2025

Goods and services tax / Harmonized Sales tax (GST/HST) credit

- January 3, 2025

- April 4, 2025

- July 4, 2025

- October 3, 2025

Ontario Trillium Benefit (OTB)

- December 10, 2024

- January 10, 2025

- February 10, 2025

- March 10, 2025

- April 10, 2025

- May 9, 2025

- June 10, 2025

- July 10, 2025

- August 8, 2025

- September 10, 2025

- October 10, 2025

- November 10, 2025

- December 10, 2025

Canada Carbon Rebate (CCR)

- January 15, 2025

- April 15, 2025

- July 15, 2025

- October 15, 2025

Alberta Child and Family benefit (ACFB)

- February 27, 2025

- May 27, 2025

- August 27, 2025

- November 27, 2025

Advanced Canada workers benefit (ACWB)

- January 10, 2025

- July 11, 2025

- October 10, 2025

If you have not received your payment, please wait for 5 to 10 working days. If, after waiting, you still haven’t received it, contact support.

Province List for GST/HST Credit and Payments

Provinces

Alberta, British Columbia, Manitoba, New Brunswick, Newfoundland and Labrador, Northwest Territories, Nova Scotia, Nunavut, Ontario, Prince Edward Island, Quebec, Saskatchewan, Yukon

Provincial and Territorial GST/HST Credit Amount 2025

According to the latest CRA reports, several credits have been cancelled, with the final payments issued in April 2025. These include the BC Climate Action Tax Credit, the Yukon Government Carbon Price Rebate, and the Nunavut Carbon Credit.

| Credit Name | Individual Amount | Spouse/Common-law Partner Amount | Child Amount | Additional Info | Reduction Threshold |

|---|---|---|---|---|---|

| BC Climate Action Tax Credit | $504 | $252 | $126 per child ($252 for first child in a single-parent family) | Combined with federal GST/HST credit | Reduced by 2% over $41,071 (single) / $57,288 (families) |

| New Brunswick Harmonized Sales Tax Credit | $300 | $300 | $100 per child ($300 for first child in a single-parent family) | Combined with federal GST/HST credit | Reduced by 2% over $35,000 |

| Newfoundland and Labrador Income Supplement | $520 | $589 | $231 per child | NLDA benefit available for eligible individuals | Based on adjusted family net income |

| Newfoundland and Labrador Seniors’ Benefit | $1,516 | – | – | For seniors (65+) with income ≤ $29,402 (partial benefit up to $42,404) | Based on adjusted family net income |

| Northwest Territories Cost of Living Offset (Zone A) | $441 | – | $505 per child | Based on postal code zones, combined with federal GST/HST credit | No reduction based on income |

| Northwest Territories Cost of Living Offset (Zone B) | $451 | – | $515 per child | Based on postal code zones, combined with federal GST/HST credit | No reduction based on income |

| Northwest Territories Cost of Living Offset (Zone C) | $470 | – | $534 per child | Based on postal code zones, combined with federal GST/HST credit | No reduction based on income |

| Nova Scotia Affordable Living Tax Credit | $255 | $255 | $60 per child | Combined with federal GST/HST credit | Reduced by 5% over $30,000 |

| Nunavut Carbon Credit | $100 | $100 | $100 per child | Combined with federal GST/HST credit | – |

| Ontario Sales Tax Credit | $360 | $360 | $360 per child | Part of Ontario Trillium Benefit, option for monthly or lump-sum payment | Reduced by 4% over $27,729 (single) / $34,661 (families) |

| Prince Edward Island Sales Tax Credit | $110 | $55 (spouse/dependant) | – | Supplement of 0.5% of income over $30,000 (max $55), reduced by 2% over $50,000 | Reduced by 2% over $50,000 |

| Saskatchewan Low-Income Tax Credit | $398 | $398 | $157 per child (max 2 children) | Max annual credit: $1,110 per family | Reduced for incomes over $37,584, phased out by $77,947 |

| Yukon Government Carbon Price Rebate | $310 | $310 | $310 per child | Additional remote supplement: $62 per person | No reduction based on income |

Extra Payments in 2024-2025

Qualified Canadians will receive extra GST payments in 2024-2025. In 2025, married couples may receive up to $680 in tax credits, while single individuals may qualify for up to $519. Each child may be eligible for an additional $179 in credits.

The extra GST credit mainly depends on the number of children, family members, and dependents under 19 years old. The main goal of the extra payment is to improve the quality of life for individuals and families. Payments will be deposited directly into the users’ provided accounts.

You don’t need to apply separately for the GST/HST credit if you have already filed your tax returns through GST/HST NETFILE; you will automatically be considered for the upcoming credit amounts based on your net income.

GST Rebate Schedule Announcement

GST rebate payments have been closed since April 2025, which previously fell on quarterly dates each year. For the remaining schedule, the CRA will announce new dates. In previous cases, you were eligible for the GST rebate under the following situations.

- If you have paid the amount in error

- Amounts paid in error for property or a house

- In the case of segregated funds and specific investment plans

- A non-resident who exports commercial goods and artistic works

In the budget for the year 2024, the Canadian government proposed an increase in the GST/HST payment for the Grocery Rebate. If you qualify for the Grocery Rebate and receive it in July 2024, it will double your January 2025 payments. There is a higher likelihood of receiving your payment in July 2024 among upcoming payments.

GST Credit Cheque Schedules 2025

The Canadian government will issue cheques to taxpayers as GST/HST credit funds. If you have already filed your tax return, you will be considered for GST/HST credit payments. The exact cheque dates in 2025 will fall on the same dates as those announced by the CRA for GST/HST payments mentioned above.

If you are turning 19 years old and have filed your tax returns for the GST/HST credit, it may cause an issue with your first payment after turning 19. For other cases, please wait at least 10 working days to receive your payment

GST/HST credit will increase by 2.7% in July 2025.

GST Payment Amounts 2024-2025

In the 2024 budget, the Canadian government proposed GST/HST payment amounts for Canadians based on their net income for 2022 and 2023. The following are the amounts to be paid to individuals based on their yearly net income.

| Marital Status | Amount to be Paid |

|---|---|

| Single Individual (without children) | $519 |

| Married or in common-law relationship | $680 |

| Family of four | $1038 |

| Child under 18 years of age | $179 |

Net Income Year Dependency

- The GST payment amounts for October 2024 and January 3rd 2025 will be based on your net income for the year 2023.

- The GST payment amounts for January, April, and July 2024 will be based on your net income for the year 2022.

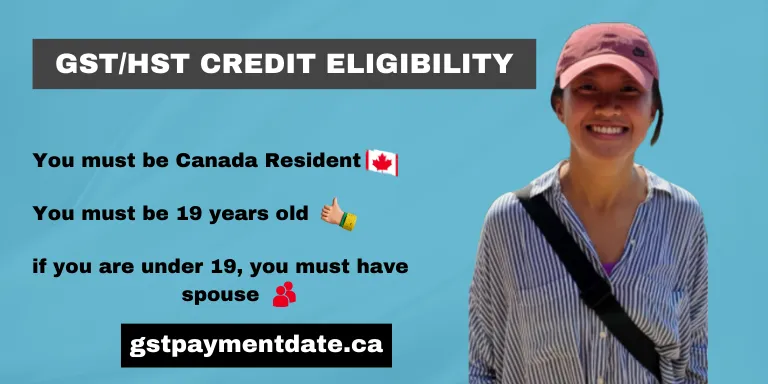

GST/HST Credit Eligibility Criteria

The CRA has established a non-taxable program called the GST/HST credit, which is paid quarterly to individuals and families with low and modest incomes to help support their income.

The following is the eligibility criteria for the GST/HST credit in Canada:

- You must be a resident of Canada for income tax purposes.

- You must be at least 19 years old.

- If you are under 19 years old, keep the following in mind:

You must have a spouse or have a common-law partner

You must be a parent or you are living with your child

Read more about : GST Credit Eligibility

Ineligibility for GST/HST Credit

Note: If you meet any of the above scenarios, you are not eligible to receive the GST/HST credit for your children, spouse, or common-law partner.

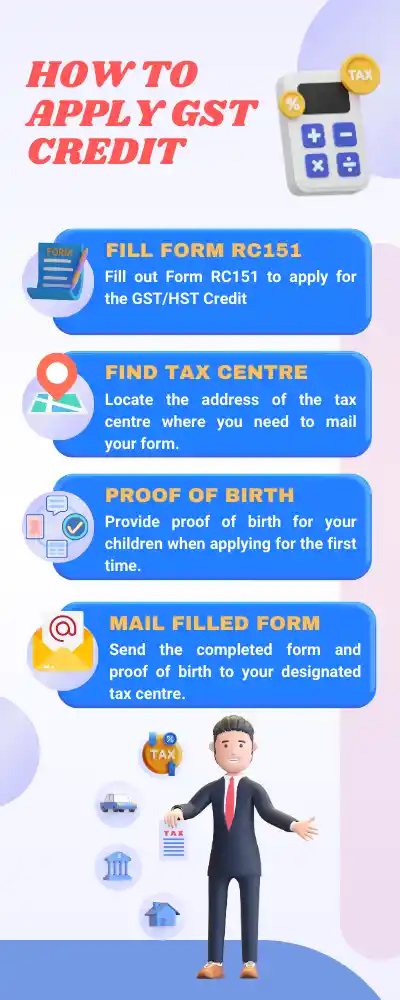

How to Apply for GST Credit

- Fill out Form RC151 for the GST/HST Credit and Canada Carbon Rebate application if you are an individual or a new resident of Canada.

- Locate the address of the tax Centre where you need to mail your form.

- Provide proof of birth for your children when applying for the first time. For more details, visit supporting documents.

- Send the completed form and proof of birth to your designated tax Centre.

GST/HST Credit Calculation

GST/HST credit calculations totally depend on your net income and on the following:

Adjusted Family Net Income

For single individuals, the GST/HST credit calculation is based on the amount from line 23600 of your tax return. For married or common-law partners, it is based on the combined net incomes of both partners

Children

Children under 19 registered for the Canada Child Benefit and GST/HST credit. In case the number of eligible children changes, it would also change your GST payment calculation. Please Inform CRA in this scenario

For GST sales and reverse sales tax calculations, a GST calculator is used.

Payment Period for July 2024- June 2025 Calculation

There are specific payments set for single individuals and married people as follows:

Calculation Method: Each child under 19 years old will receive $179. For example, if you have 3 children under 19 years old, they will receive $537 (179 * 3).

GST/HST Credit Recalculation

In the following scenarios, the CRA can recalculate your GST/HST Credit:

- Changes to your spouse’s or common-law partner’s tax return that affect net income.

- Changes in your marital status.

- Changes in the number of eligible children in your care.

- Death of the GST/HST credit recipient.

GST/HST Credit Overpayment

If you are overpaid by the CRA for GST/HST credit, they will send you a notice with a remittance voucher indicating how much you owe. They may withhold some or all of your future GST/HST credit payments, Canada Child Benefit, or GST/HST refunds until you repay the amount owed. Similar actions could occur with other programs managed by the CRA.

Retroactive GST/HST Credit and Payments List

You can request the CRA to issue GST/HST credit retroactively for up to 10 years by submitting an application form. Retroactive GST/HST credit and payments were announced for July 2023 to June 2024 for different zones like ZONE A, B, and C based on location.

Payment Amounts and Communities List

| Payment Amounts | Communities |

|---|---|

| $441 per adult | Colville Lake, Dettah, Enterprise, Fort Good Hope, Fort Resolution, Fort Smith, Hay River, Kakisa, Kátl’odeeche, Ndilo, Wrigley, Yellowknife |

| $493 per child | Colville Lake, Dettah, Enterprise, Fort Good Hope, Fort Resolution, Fort Smith, Hay River, Kakisa, Kátl’odeeche, Ndilo, Wrigley, Yellowknife |

| $483 per adult | Aklavik, Behchoko, Deline, Fort Liard, Fort McPherson, Fort Providence, Fort Simpson, Gametì, Inuvik, Jean Marie River, Lutselk’e, Nahanni Butte, Sambaak’e, Tsiigehtchic, Tuktoyaktuk, Wekweèti, Whatì |

| $535 per child | Aklavik, Behchoko, Deline, Fort Liard, Fort McPherson, Fort Providence, Fort Simpson, Gametì, Inuvik, Jean Marie River, Lutselk’e, Nahanni Butte, Sambaak’e, Tsiigehtchic, Tuktoyaktuk, Wekweèti, Whatì |

| $558 per adult | Norman Wells, Paulatuk, Sachs Harbour, Tulita, Ulukhaktok |

| $610 per child | Norman Wells, Paulatuk, Sachs Harbour, Tulita, Ulukhaktok |

GST/HST Penalties and Interest

There are two rules set by the CRA for penalties and interest, applicable as follows:

- Interest for Late Payment

- Penalty for Late Filing

GST/HST Late Payment Interest

There are three types of interest rates set by the CRA in case of late GST/HST payment:

- Arrears Interest

- Installment Interest

- Refund Interest

Arrears Interest

Installment Interest

The CRA charges interest if you fail to pay GST/HST installment payments on time or if the payments are insufficient. The interest begins from the day your installments are due and continues until the overdue amount is paid. This interest can be avoided by paying installments on time, or it can be reduced by overpaying or paying the next installment early.

Refunds Interest

- CRA pays interest on overpayments or refunds of net tax claimed on a GST/HST return.

- Interest is added daily.

- The interest calculation begins 30 days after the return is filed and ends on the day the refund is paid or applied.

- CRA updates the interest rate every three months

GST/HST Late Filing Penalty

Condition: When any return is filed late unless there is $0 owing, or a refund is due.

Penalty Amount Charged: A+(B×C)

A = 1% of the amount owing

B = 25% of A

C = Number of complete months the return is overdue, to a maximum of 12 months

Condition: If you receive a demand to file and do not do so.

Penalty Amount Charged: $250

Condition: If you are required to file electronically and do not do so.

Penalty Amount Charged:

- $100 for the initial return not filed electronically.

- $250 for each subsequent return not filed electronically.