Grocery Rebate 2025 Canada (Dates and Eligibility)

The previous grocery rebate was released on July 5, 2023. In the 2024 budget of Canada, there was no announcement of a grocery rebate. People are hoping to get grocery rebate in 2025. There is no grocery rebate in 2024 announced by the CRA, despite numerous questions from Canadians on Twitter. Let’s hope it will be announced again in 2025.

In 2024, there is no announced payment date yet. To receive the grocery rebate, you must meet the eligibility requirements. Let’s explore all grocery rebate requirements, calculations, and when it will be paid.

According to the Canada Revenue Agency’s official Facebook page, there is no grocery rebate in 2024. However, for more information, keep an eye on the latest updates regarding the grocery rebate.

| Program Name | Canada Grocery Rebate |

| Managed By | CRA |

| Age Limit | 19 years |

| Payment Method | Check or Deposit |

| Also Check | Gst Payment Dates |

Grocery Rebate Eligibility

Due to an increase in inflation, it has become difficult for people to purchase basic necessities for their families, children, or homes. To assist these individuals, the Government of Canada introduced a grocery rebate in 2023. This rebate serves as a top-up to the regular GST/HST credit payment for eligible individuals. Below are the requirements for receiving grocery rebate payments:

- File a tax return for 2021. Filing an income tax return is mandatory because the final amount is calculated based on your income tax return.

- If you are receiving the GST/HST credit this year, you can still get the grocery rebate.

- The person must meet income tax requirements and be older than 19 years.

- If a Canadian person earns less than $45,000 in a year, they will receive the full one-time grocery rebate payment.

- The total family income should not be more than $65,000.

You will not receive payments if

How Grocery Rebate Payment Calculated?

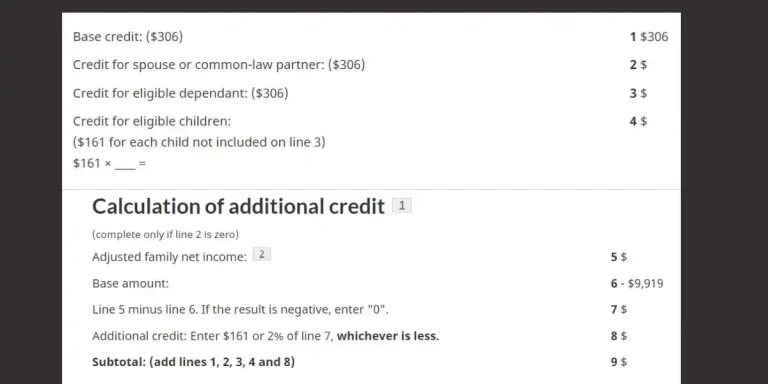

The Canada Revenue Agency (CRA) mainly deals with the grocery rebate. Grocery rebate in Canada is not calculated on an individual basis. Many factors are considered, such as:

- Previous tax return

- Marital status

- Family status, including:

- If you are single

- If you have one child

- Your overall family size

- Mainly, your family status will determine the grocery rebate income.

- Calculate grocery rebate.

According to the Canada government website, here is the chart of payments you may receive.

If you were single

| Family Status | Rebate Amount |

|---|---|

| No children | $234 |

| With 1 child | $387 |

| With 2 children | $467 |

| With 3 children | $548 |

| With 4 children | $628 |

If you were married or had a common-law partner

| Family Status | Rebate Amount |

|---|---|

| No children | $306 |

| With 1 child | $387 |

| With 2 children | $467 |

| With 3 children | $548 |

| With 4 children | $628 |

Rebate amounts may change with new announcements by the Canadian government. You can also check CPP Payment dates.

There was no grocery rebate in July 2024… I saw that they were giving the grocery rebate in August but still nothing we need to be update on a date when we’re getting it the cost of food is not going down please help us with the cost of living

hoping govt may announce again.

There was no grocery rebate in July 2024… I saw that they were giving the grocery rebate in August but still nothing we need to be updated

you are right. we are hoping for it soon