GST/HST NETFILE Online (Filing the Returns)

If you are an individual or running a business that generates $30,000 (30k) or more in revenue, you must register and file GST/HST returns through the GST/HST Netfile. This will make you eligible for rebates directly from the CRA over the internet. Follow the step-by-step guidelines below to learn how to file online through login or on paper.

A GST/HST number and access code provided by the CRA are required to register for GST/HST Netfile. After filing your return online, the CRA confirms your return immediately, and within seconds, your payment history and status can be viewed in your account. The Netfile and Refile filing process is open electronically from February 19, 2024, to January 24, 2025.

GST/HST NETFILE Online

It is mandatory to avoid penalties for late GST/HST filing, as the CRA announces GST payment dates every year to adjust tax calculations.

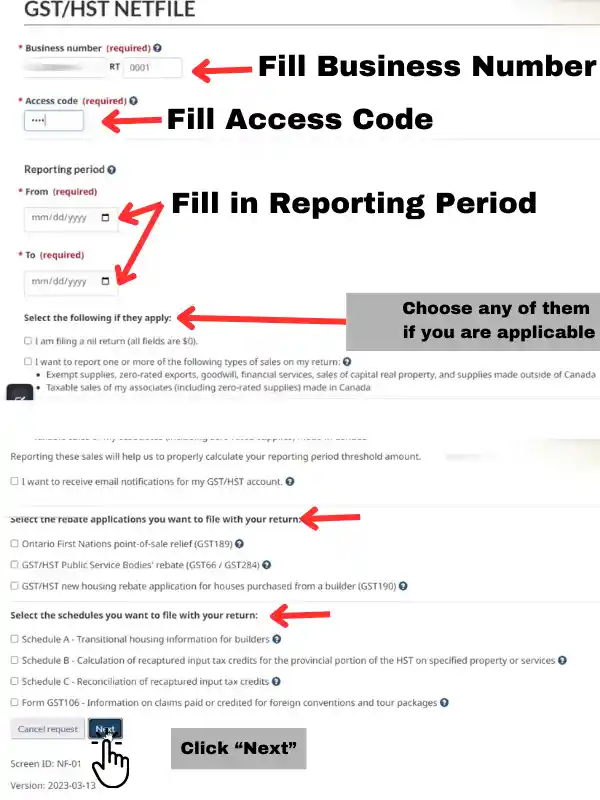

- To start filing online for the GST returns, first make sure that you have generated your GST Number, and the CRA has already assigned you a 4-digit access code.

- Click on the “Ready to file” button below to start your filing process online.

- This will open a page that allows you to input your details to file the returns.

- Enter your 9-digit business number in the first box, including the 4-digit RT in the second box.

How to get GST NETFILE Access Code?

- In the next step, enter your 4-digit “Access Code” in the box.

- The CRA provides you with the “Access Code” through the mail, which enables you to file the returns electronically.

- If you don’t receive the access code, you can call the following phone numbers for assistance:

For Canada: 1-800-959-5525

For Outside Canada and the USA: 613-940-8497

Otherwise, click the button below to generate your ‘Access Code’ using your GST/HST business number.

GST/HST NETFILE using Login

- Now pick your reporting period date from the calendar. You can choose from the start of the year to the end of the year.

- In the next section, if you are applicable to these terms, select any option from them. These include applications for rebates like Grocery Rebate and Public Service Body Rebates; otherwise, click “Next.”

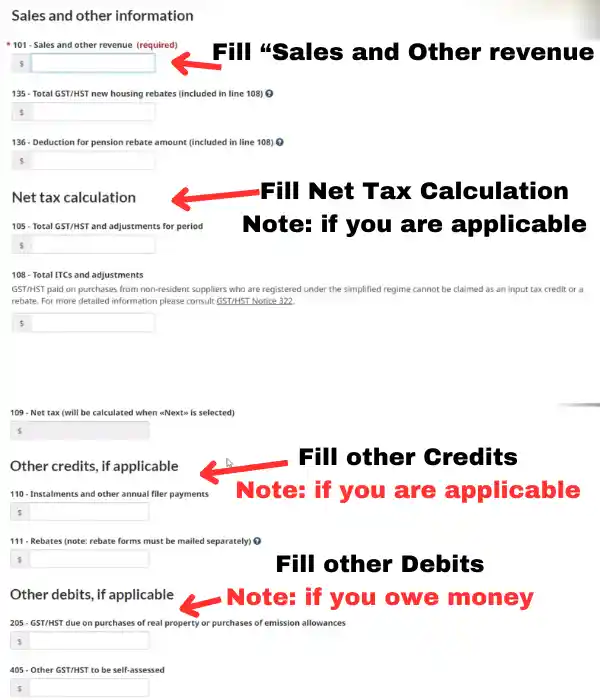

- On the next screen, you will see a summary of your filled details regarding the GST/HST return.

- Please double-check your details to ensure there are no typing mistakes.

- In case you want to edit your details, click on the “Previous” button and carefully edit your details.

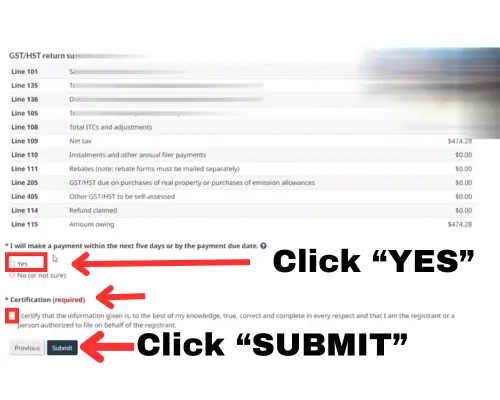

- Otherwise, click the mandatory two fields after confirming your details.

- Click on the “Submit” button for the last step.

In the first field, it will ask you to make the payment within the next five days or within the due dates. Click on “yes.”

In the second field, they will ask you to confirm certification, so check the box and move to the next step for the next process.

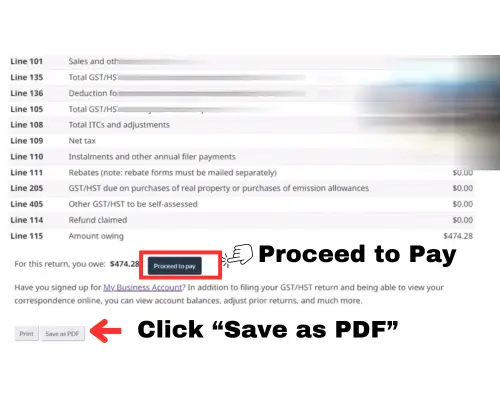

- In the final step, if you want to make your payments, click on the “Proceed to Pay” button.

- Please don’t forget to save the PDF file of your details regarding the GST/HST filing.

- Congratulations, you have filed your GST/HST NETFILE online for the GST/HST returns.

Keeping scheduled dates for Canadian residents is mandatory for every process, whether it’s GST Netfile or the CPP Payments Program

GST/HST NETFILE Eligibility Criteria

- Your net income threshold exceeds $30,000.

- You must be registered for GST/HST with the CRA and have an account number.

- You must have a GST Business number and an access code provided by the CRA.

- You are eligible for all types of GST/HST returns, including regular, quarterly, and annual.

- If you owe any amounts to the CRA, you are still eligible, but you must make payments through any available method.

GST/HST NETFILE Ineligibility

You are restricted from filing these types of tax returns electronically to the CRA:

Tax returns for the years 2017, 2018, 2019, 2020, 2021, 2022, or 2023.

Each person must send his or her own tax return.

If you are not a resident of Canada.

If you declared bankruptcy in the years 2023 or 2024.