CCB (Canada Child Benefit) Payment Dates 2025

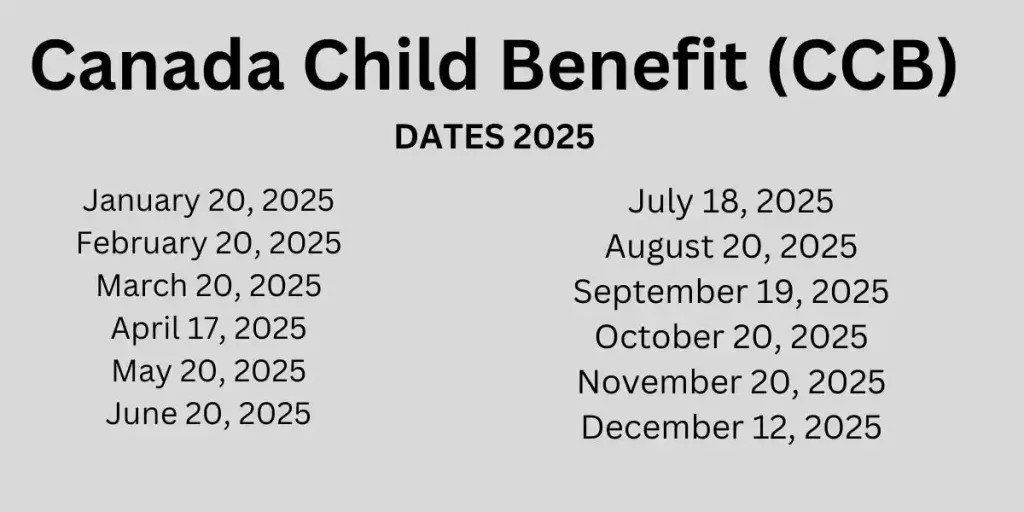

Canada Child Benefit (CCB) payment dates for 2025 are January 20, February 20, March 20, April 17, May 20, June 20, July 18, August 20, September 19, October 20, November 20, and December 12. Parents can expect to receive their payments on these dates. If you are applying for the CCB, you can receive your payments within 8 weeks if you submit your application online or within 11 weeks if you apply by mail.

Children under the age of 6 will receive a total of $7,787 in 2025 ($648.91 per month). Children aged 6 to 17 will receive a total of $6,570 in 2025 ($547.50 per month). According to the new policy, the payment distribution has increased by 4.7% from the previous year.

Lets explore all 2025 child tax benefit dates, its criteria and eligibility, application process and many important stuff of it.

Canada Child Benefit Payment Dates 2025

CCB dates are different from GST/HST dates and CPP dates.

| Month | Date |

|---|---|

| January 2025 | 20 |

| February 2025 | 20 |

| March 2025 | 20 |

| April 2025 | 17 |

| May 2025 | 20 |

| June 2025 | 20 |

| July 2025 | 18 |

| August 2025 | 20 |

| September 2025 | 20 |

| October 2025 | 20 |

| November 2025 | 20 |

| December 2025 | 12 |

What Payment to be Received?

- Children under the age of 6 will receive up to $7,787 in 2025.

- Children aged 6 to 17 will receive up to $6,570 in 2025.

- This represents an increase of 4.7% from the previous year.

What is Eligibility Criteria for 2025?

- Parents, along with their children, must be Canadian residents.

- Parents must be living in Canada with their children at the time CCB payments are received.

- Children under 18 are eligible for the CCB.

- A child eligible for the Disability Tax Credit (DTC) can receive up to $3,322 extra per year.

- If a child passes away, CCB payments will continue for six months.

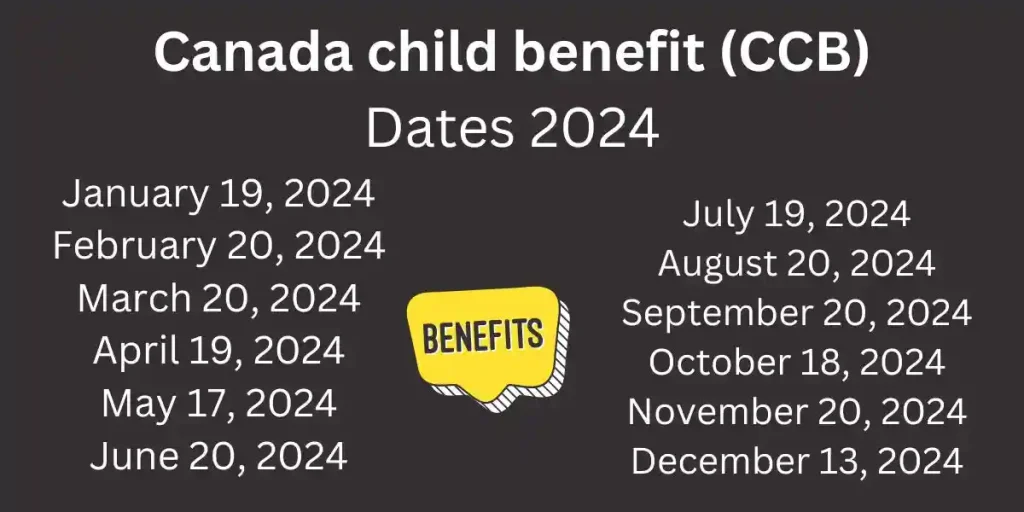

CCB Payment Dates 2024

| Month | Date |

|---|---|

| January 2024 | 19 |

| February 2024 | 20 |

| March 2024 | 20 |

| April 2024 | 19 |

| May 2024 | 17 |

| June 2024 | 20 |

| July 2024 | 19 |

| August 2024 | 18 |

| September 2024 | 20 |

| October 2024 | 18 |

| November 2024 | 20 |

| December 2024 | 13 |

Who Can Apply For child tax benefit Canada?

You can apply if you meet all the following conditions:

- Your child is under 18, and you are primarily responsible for their upbringing and care.

- You are a resident of Canada for tax purposes. Also, you or your common-law partner must be one of the following:

- A Canadian citizen or a permanent resident of Canada

- A protected person (received a positive decision notice from the Immigration and Refugee Board)

- A temporary resident who has been in Canada for the last 18 months and has a valid permit in the 19th month, except for permits that don’t grant resident or temporary resident status

- Registered or eligible for registration under the Indian Act

If a foster child is receiving the Children’s Special Allowance (CSA) in any month, then you will not receive the CCB. Also check the grocery rebate criteria.

When and How to Apply for CCB?

You should apply in the following circumstances:

- A child is born, or a child starts to live with you after a temporary period.

- You start, end, or change a shared custody arrangement.

- You gain custody of a child.

- If a child starts living with you for more than 11 months, provide additional documents.

- Please note that there is no need to apply separately for territorial or provincial programs because the CRA will verify your eligibility when you apply for the CCB.

How to Apply for Canada Child Benefit?

Through Birth Registration: When you register the birth of your newborn, you can apply for the CCB. Most registrations are done at the hospital or birth center. People in Ontario, Alberta, British Columbia, and Quebec can also apply online. Ensure you provide your Social Insurance Number (SIN) and consent for the vital statistics agency to share your birth registry information with the CRA. If you don’t consent, your information will not be sent, and you will need to apply separately for the CCB.

Online via My Canada Account: If you did not apply after the birth of your newborn, you can apply online using My Account (Your CRA account).

First sign in to your account. Now click on benefits and credits from navigation menu from the left side of screen. Go to the Benefits and credits page, find the Child information section, and click on + Add.

Now Confirm info ➡️ Enter child’s info ➡️ Review and submit ➡️ Confirmation screen ➡️ Click “Submit documents” if asked.

BY Mail: Fill out and sign Form RC66 ➡️ Include needed documents ➡️ Mail to your tax center.

If you apply online you will receive payments within 8 weeks. While if you apply by mail you will receive payments after 11 weeks.

How much CCB amount will you receive?

- The Canada Child Benefit amount is recalculated every July each year based on the family’s net income from the previous year.

For example, payments are based on: