Carbon Tax Rebate Payment Dates 2025 (Eligibility, Amounts)

Carbon Tax Rebate Payment Dates for 2025, also known as the Climate Action Incentive payment, will fall on January 15, April 15, July 15, October 15 2025. The government has updated the supplements for rural areas and has made some changes in certain situations. To learn about the Carbon Tax Rebate, follow the step-by-step guidelines below.

The schedule for the Carbon Rebate Tax, known as the Climate Incentive Tax, applies to the residents of provinces such as Ontario, Manitoba, Saskatchewan, Alberta, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island. In the details below, you will learn about the eligibility criteria for receiving the carbon tax rebate and the prices set according to each province.

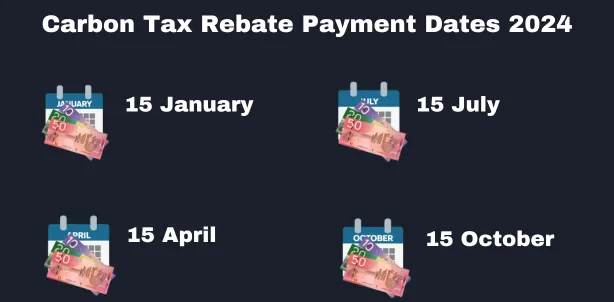

Carbon Tax Rebate Payment Dates 2025

The federal government has set the payment distribution of the carbon tax rebate to align with GST payments in order to reduce carbon emissions and greenhouse gas emissions for residents of Canada. Here are the payment dates for the carbon tax rebate:

- January 15, 2025

- April 15, 2025

- July 15, 2025

- October 15, 2025

If the 15th of the above-mentioned dates falls on a Saturday, Sunday, or federal holiday in Canada, the payment process will be moved to the previous business day before the 15th.

Carbon Tax Rebate Payment Amount 2025

Carbon Tax Rebate payment amounts for 2025 vary by province and are provided quarterly according to the above-mentioned dates. The federal government has proposed a new increase in the payments for rural areas, raising the proposed amount from 10% to 20% of the base amount for rural supplements.

Here are the payment amounts for 2025 according to the Department of Finance Canada.

| Province | First Adult | Second Adult | Each Child | Family of 4 |

|---|---|---|---|---|

| Alberta | $225 | $112.5 | $56.25 | $450 |

| Manitoba | $150 | $75 | $37.5 | $300 |

| Ontario | $140 | $70 | $35 | $280 |

| Saskatchewan | $188 | $94 | $47 | $376 |

| New Brunswick | $95 | $47.5 | $23.75 | $190 |

| Nova Scotia | $103 | $51.5 | $25.75 | $206 |

| Prince Edward Island | $110 | $55 | $27.5 | $220 |

| Newfoundland and Labrador | $149 | $74.5 | $37.25 | $298 |

Factors Influencing Payment Amount Changes

If you move to a different province or territory, the payment amount for 2025 will change according to your new location.

Other factors that can affect your payment amounts include:

- Your marital status

- Your child turning 19 or being under 19

- The arrival of a new child in your family

- The death of a CCR recipient.

Carbon Tax Rebate Eligibility

There have been some additions to the Carbon Tax Rebate eligibility criteria. The eligibility will now be based on the 2016 census data. If you were ineligible according to the 2021 census data for the Climate Action Incentive, you will now be considered eligible. Following is the eligibility criteria for the Carbon Tax Rebate for 2024-2025.

In case of if you are having children

If you have children, the following eligibility criteria must be met:

- Your child must be under 19 years of age.

- Your child must live with you.

- Your child must be registered for the CCR.

Note: If your child is already registered for the CCB or GST/HST Credit, they will be automatically qualified for the Carbon Tax Rebate payments.

Eligible and Ineligible Provinces List

Eligible Provinces

Alberta, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, Prince Edward Island, Saskatchewan

Ineligible Provinces

CCR is not applicable in these provinces or territories:

British Columbia, Northwest Territories, Nunavut, Quebec, Yukon

FAQS

For Other Payment Dates and Canada Tax Information: