CWB (Canada Workers Benefit) Payment Dates 2025

Because inflation is rising to 4%, many Canadian workers face difficulty meeting their daily needs. That’s why the government launched the CWB (Canada Workers Benefit) for deserving Canadian workers. Its primary purpose is to help those whose income is low.

The CWB dates for this year are January 10, 2024, July 11, 2025, and October 10, 2025.

| Program Name | CWB |

| Managed By | CRA |

| Age Limit | 19 years, Canadian Citizen |

| Next Payment Date | July 11, 2025 |

| Also Check | Grocery Rebate Payment Dates |

CWB Payment Dates 2024

Starting in July 2023, the CWB is providing advance payments equal to 50% in three installments under the ACWB (Advanced Canada Workers Benefit). CWB payments are based on the previous year’s tax return. If you received payments in 2023, you do not need to apply again because you will also receive them in 2024 automatically by the CRA (Canada Revenue Agency).

Check Dates for CCB Payment Dates, GST Payment Dates and GST, HST Netfile.

CWB PAYMENT DATES 2023

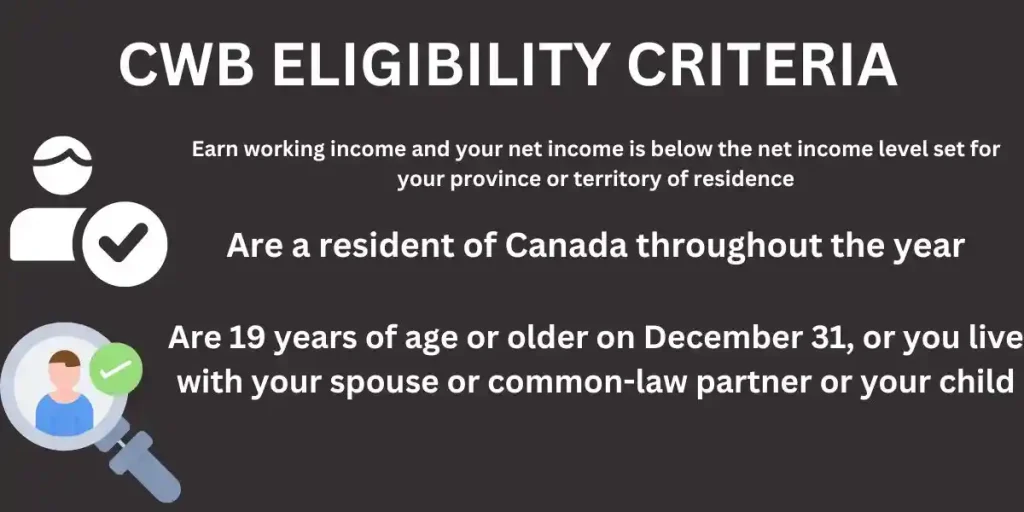

Canada Workers Benefit (CWB) Eligibility

- You should be a resident of Canada throughout the year.

- You should be 19 years old or above, or live with your husband or wife, or with your child.

- Earn working income, and if your net income is less than the amount set for your province or territory.

Disability supplement eligibility is another part of CWB. Here is its eligibility criteria

- If eligible for Disability tax credit

- Approved Form T2201 on file with the CRA.

- Net income is less than the criteria set by the province or territory.

You will not be eligible if

- Does not pay tax in Canada due to any reason, such as being a servant or bureaucrat from another country, or a family member of such a person.

- You were in prison (or similar situation) more for than 90 days.

- You are a full-time student at a recognized educational institution for more than 13 weeks in the year. (unless you have an eligible dependent on December 31)

How much CWB you can get?

The amount of Canada Workers Benefit depends on many factors such as working income, marital status, number of dependents, and province or territory. Quebec, Alberta, and Nunavut have different amounts than other provinces and territories.

| Category | Maximum Basic Benefit Amount | Income Thresholds |

|---|---|---|

| Single Individuals | $1,518 | Reduced if adjusted net income > $24,975 No benefit if adjusted net income > $35,095 |

| Families | $2,616 | Reduced if adjusted family net income > $28,494 No benefit if adjusted family net income > $45,934 |

Disability Supplement Amount

| Category | Maximum Disability Supplement Amount | Income Thresholds |

|---|---|---|

| Single Individuals | $784 | Reduces if income is over $35,098 No supplement if income is over $40,325 |

| Families | $784 | Reduces if family income is over $45,932 No supplement if one spouse qualifies for disability tax credit and family income is over $51,159 No supplement if both spouses qualify for disability tax credit and family income is over $56,386 |

How to apply for the Canada Workers Benefit?

File your taxes electronically using certified tax software.

If filing a paper return, complete and submit Schedule 6, Canada Workers Benefit

If eligible, claim the disability supplement:

- If you and your spouse are eligible for the disability tax credit, the eligible person should claim both the basic amount and the disability supplement.

- If both spouses qualify for the disability tax credit, only one can claim the basic amount, but each must separately claim the disability supplement using separate Schedule (Source Canada Government site).

- Check GST/HST Number Registration and Lookup Online