GST/HST Holiday Tax Break 2025

From December 14, 2024, to February 15, 2025, the Canadian government will provide GST relief on certain items. This includes food, beverages, restaurant meals, clothing, and more. Any item fully paid for or delivered between December 14 and February 15 will be exempt from GST.

If you are a shopkeeper and purchase GST-break-qualifying items, you will also receive these products without GST tax. It means as a shopkeeper you will automatically receive the yax break.

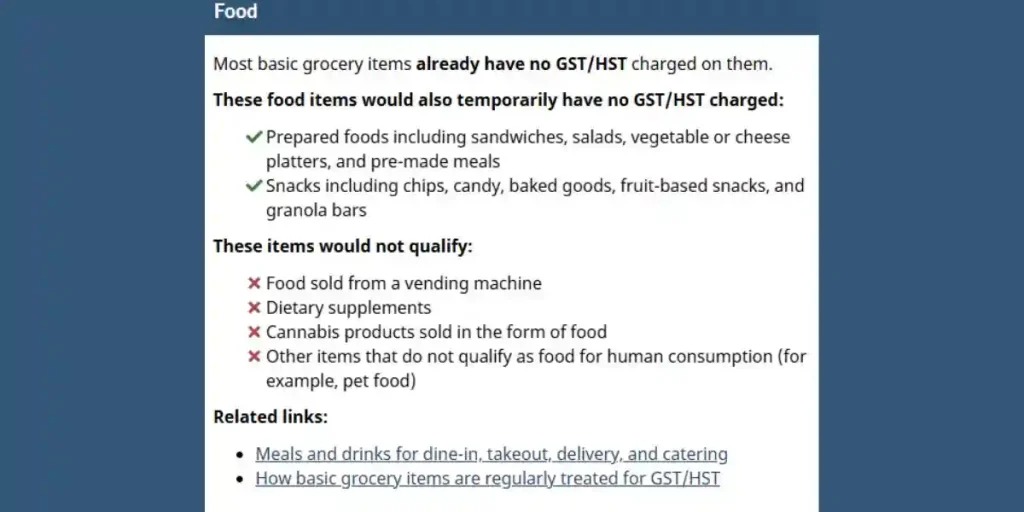

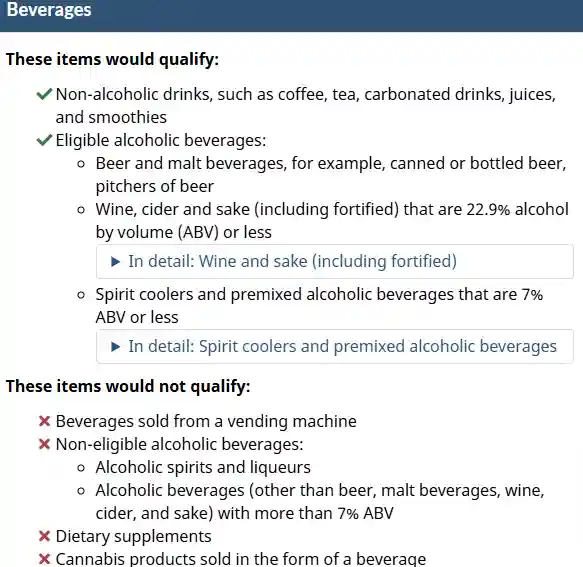

GST/HST Break Qualifying Items

| ||

| ||

|

Restaurants, catering |

| |

|

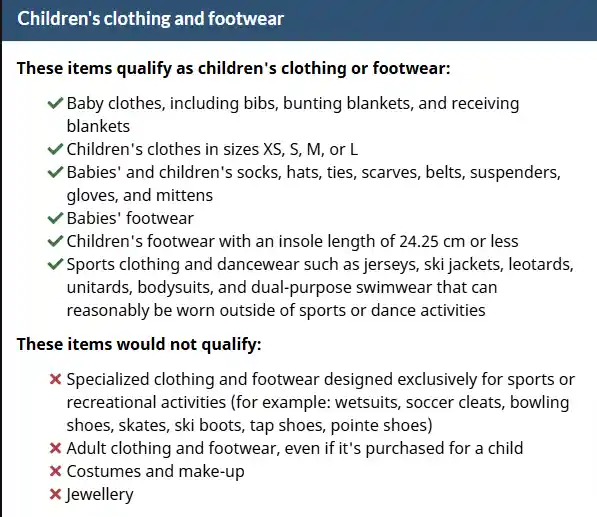

Children’s clothing and footwear | ||

|

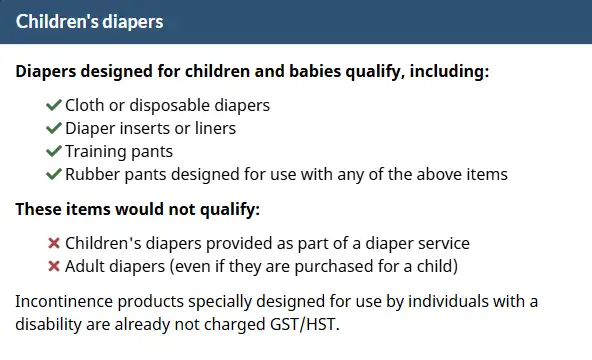

Diapers |

| |

|

Puzzles |

Jigsaw puzzles. | |

|

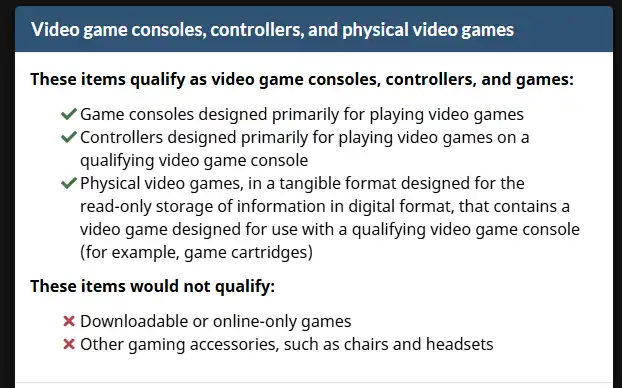

Video game consoles |

| |

|

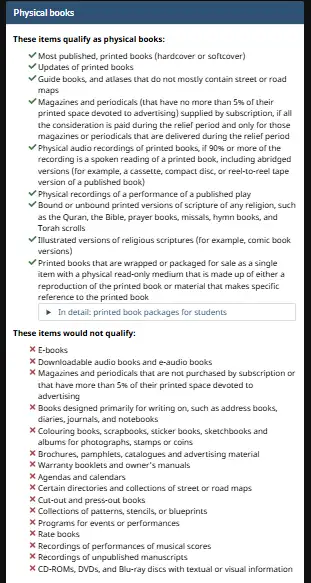

Physical books |

| |

|

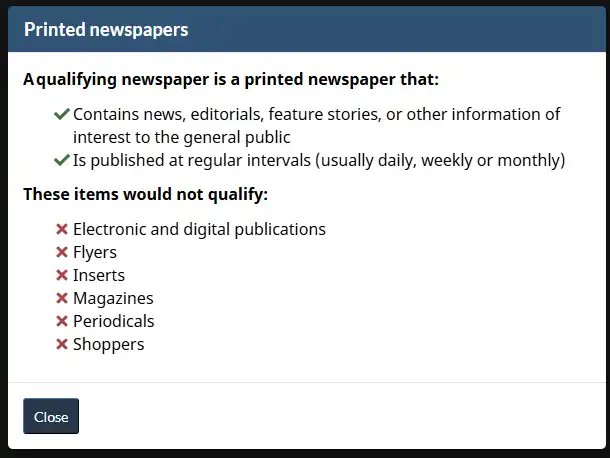

Printed newspapers |

| |

|

Christmas and similar decorative trees |

|

Check the GST payment dates for 2025 and learn more about GST break products here.