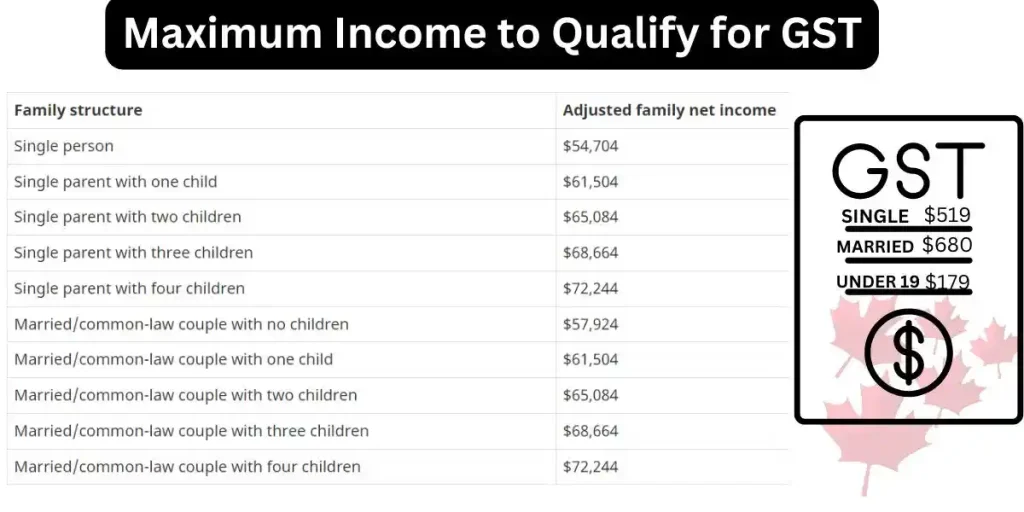

What is the maximum Income to Qualify for GST (2024)

The maximum income to qualify for the GST or HST credit in 2024 mainly depends on a person’s marital status and number of children. GST payments are mostly released in the first week of January, April, July, and October. You can check the dates in detail and also calculate GST from here.

From July 2024 to June 2025 here is breakdown

| Category | Amount |

|---|---|

| Single | $519 |

| Married or common-law partner | $680 |

| Each child under 19 | $179 |

Income Level Where GST/HST Credit Stops

If your family net income is more than the amount indicated in the table below, you will not receive GST payments. This year’s payments start from July 2024.

| Family Structure | Adjusted Family Net Income |

|---|---|

| Single person | $54,704 |

| Single parent with one child | $61,504 |

| Single parent with two children | $65,084 |

| Single parent with three children | $68,664 |

| Single parent with four children | $72,244 |

| Married/common-law couple with no children | $57,924 |

| Married/common-law couple with one child | $61,504 |

| Married/common-law couple with two children | $65,084 |

| Married/common-law couple with three children | $68,664 |

| Married/common-law couple with four children | $72,244 |

According to the Government of Canada website, here are more eligibility points to qualify for GST/HST payments.

You are at least 19 years old. If under 19, you must meet one of these conditions:

- Have a spouse or common-law partner.

- Be a parent and live with your child.

- You are a Canadian resident for income tax purposes:

- At the beginning of the month when the CRA makes a payment.

- In the month before the CRA makes a payment.

| CCB Payment Dates | Grocery Rebate Payment Dates |

| CPP Payment Dates | Carbon Tax Rebate Payment Dates |

| Canada Workers Benefit | GST/HST Number |