CPP Payment Dates 2025 (OAS, Disability)

Eligible individuals will receive CPP payments on january 29, 2025 . The previous CPP payment date was december 22, 2024. These payments encompass Canada Pension Plan (CPP) benefits, which include retirement, disability, children’s benefits, and survivor benefits.

CPP Payment Dates 2025

The list also includes the disability CPP payment dates, Old Age Security (OAS) dates, as well as dates for all eligible Canada Pension Plan candidates. Payments are usually released on the last three banking days of the month, but this can change due to various circumstances. Cpp schedule is different from gst payment dates and grocery rebate.

| Month | Payment Date | Payment No |

|---|---|---|

| January | January 29, 2025 | First payment of the year |

| February | February 26, 2024 | Second Payment |

| March | March 27, 2025 | 3rd Payment |

| April | April 28, 2025 | 4th Payment |

| May | May 28, 2025 | 5th Payment |

| June | June 26, 2024 | 6th Payment |

| July | July 29, 2024 | 7th Payment |

| August | August 27, 2024 | 8th Payment |

| September | September 25, 2024 | 9th Payment |

| October | October 29, 2024 | 10th Payment |

| November | November 26, 2024 | 11th Payment |

| December | December 22, 2024 | Last payment of the year |

A person can spend almost 30 years in retirement. If you work in Canada between the ages of 18 and 70, then the Canada Pension Plan (CPP) can help you get a pension after retirement. The more you earn, work, and contribute to the CPP plan, the more payments you will get after retirement.

YMPE (Year’s Maximum Pensionable Earnings)

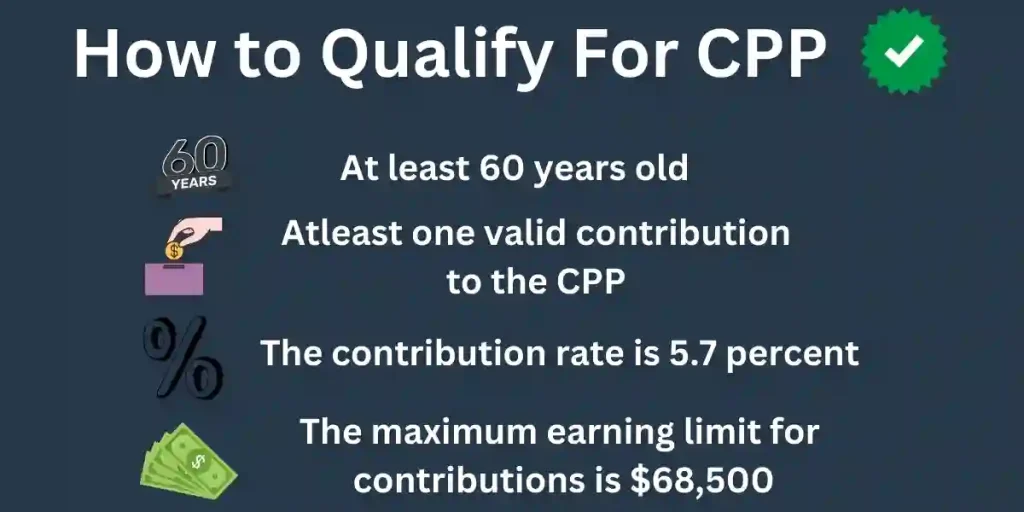

The maximum amount of contributions subject to CPP is determined by the YMPE. In 2024, the YMPE is $68,500, while in 2023 it was $66,600.

Canada Pension Plan Payment Dates 2024

| January | January 29, 2024 |

| February | February 27, 2024 |

| March | March 26, 2024 |

| April | April 26, 2024 |

| May | May 29, 2024 |

| June | June 26, 2024 |

| July | July 27, 2024 |

| August | August 28, 2024 |

| September | September 25, 2024 |

| October | October 29, 2024 |

| November | November 27, 2024 |

| December | December 20, 2024 |

How to Qualify For CPP Payments?

To qualify for the Canada Pension Plan, you must be at least 60 years old and have made at least one valid contribution to the CPP.

Valid contributions include those made from working in Canada or receiving credits from a former spouse or common-law partner. Also heck the eligibility criteria for GST/HST netfile.

CPP Contribution

How much you will receive?

Standard Age to Get CPP Payments

Payments will increase each year with the cost of living. Please note that CPP will not meet all your monthly or financial expenditures. It’s just an old age security for Canadian people.

When is the best time to start your pension?

- Think long term before starting to receive CPP payments. Let’s suppose you will live longer than your parents and grandparents; in that case, you will need more money. Here are the factors you should consider when deciding whether you should start your pension.

- If you want to work less, pay off debts, or need money immediately after turning 60, then you should start your pension in your early 60s. You will get smaller monthly payments if you start in your early 60s. However, it will help you meet your needs if you don’t have other income.

- If you are healthy, have good savings, expect to live a long life, and have other income sources, then you can start your pension at the age of 70. This will result in larger monthly payments.

How to apply for CPP Payments 2024?

First Qualify

To qualify, you should be at least 60 years old and have made legal contributions to the Canada Pension Plan. If you live in Quebec, you should apply to the Quebec Pension Plan (QPP) for pensions.

Decide When to Start

After qualification, you can now decide when to receive your pension. You will have the option to receive it at either 65 or 70. It’s up to you to decide when to start, according to your financial needs.

Decide How to Apply

You can apply using my Service Canada account or by using the paper application. You will receive a response within 120 days by email. When applying by this method, apply in advance so that you receive payments on time.

Other CPP Benefits

With CPP pension, you can also qualify for other CPP benefits like:

- CPP Post-Retirement Benefit: After retiring, if you continue to work and make contributions to CPP, you will receive additional post-retirement benefits that will increase your income.

- Disability: At the age of 65, your disability pension transitions to a retirement pension. You cannot receive both simultaneously. If you have a severe disability and are under 65 receiving CPP retirement pension, you may qualify for the post-retirement disability benefit. Children of individuals receiving a CPP disability pension can also receive a monthly payment.

- Survivors: Upon death, you may receive CPP survivor’s pension. A monthly benefit is also provided to children of deceased CPP contributors. In the event of your death, a one-time payment is made to your estate.

| Type of pension | CPP Payment Amount 2024 | Beneficiaries of new CPP |

| Retirement pension with survivor’s benefits (age 65) | $1375.41 | $999.54 |

| One-time death benefit | $2500.00 | $2499.17 |

| Post-retirement disability benefits | $583.32 | $583.32 |

| Disability benefits | $1606.78 | $1176.98 |

| Post-retirement benefits (age 65) | $44.46 | $7.09 |

| Retirement pension (age 65) | $1364.60 | $831.92 |