GST/HST Calculator and Rates

GST/HST calculation totally depends on the province you are living in. The CRA has set the tax rates according to each province in Canada. You can calculate GST/HST sales tax and reverse tax calculations by using the calculator below. You can also learn about PST tax rates for GST/HST in each province with the step-by-step guide below.

GST Sales Tax Calculator

Calculating GST/HST sales tax is necessary for businesses and individuals to ensure you remit the correct amount by the GST payment dates. You can use the calculator below to do this.

GST/HST: $0.00

PST included: $0.00

Total Amount after Taxes: $0.00

GST Reverse Sales Tax Calculator

Reverse GST Calculator helps you calculate the pre-sales tax amount of a product or service. Simply enter the amount including sales tax, and the calculator will show you the original amount of the product or service before the sales tax is applied.

GST/HST: $0.00

PST included: $0.00

Total Amount Before Taxes: $0.00

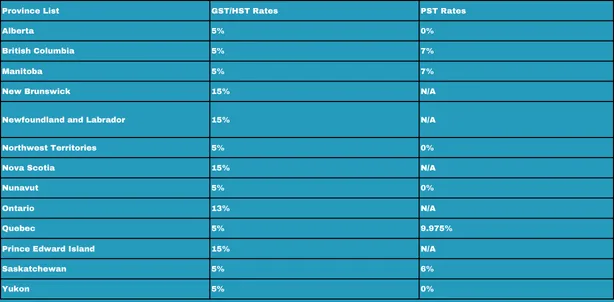

GST/HST and PST Rates

Below is the information on the GST/HST rates by province as set by the CRA. You can also see the PST rates for provinces that don’t participate in the HST.

| Province List | GST/HST Rates | PST Rates |

|---|---|---|

| Alberta | 5% | 0% |

| British Columbia | 5% | 7% |

| Manitoba | 5% | 7% |

| New Brunswick | 15% | N/A |

| Newfoundland and Labrador | 15% | N/A |

| Northwest Territories | 5% | 0% |

| Nova Scotia | 15% | N/A |

| Nunavut | 5% | 0% |

| Ontario | 13% | N/A |

| Quebec | 5% | 9.975% |

| Prince Edward Island | 15% | N/A |

| Saskatchewan | 5% | 6% |

| Yukon | 5% | 0% |

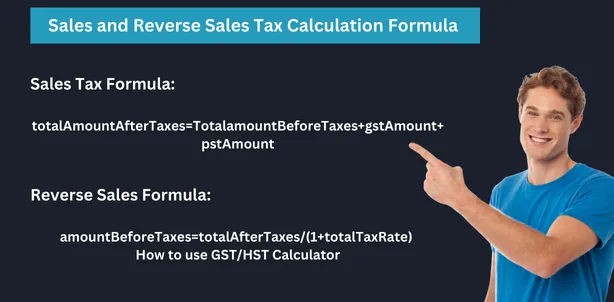

Formula to Calculate GST/HST

There are a few factors that matter when calculating the GST/HST sales tax and reverse sales tax. These factors are given below. Ensure that you are familiar with these factors, as you can see them in the table above. The factors are:

- GST Rate

- PST Rate

- Amount you enter

GST/HST Sales Tax Calculation Formula

GST Amount: gstAmount=amount×gstRate

PST Amount: pstAmount=amount×pstRate

Total Amount After Taxes:

totalAmountAfterTaxes=TotalamountBeforeTaxes+gstAmount+pstAmount

GST/HST Reverse Sales Tax Calculation Formula

GST Amount: gstAmount=amountBeforeTaxes×gstRate

PST Amount: pstAmount=amountBeforeTaxes×pstRate

Total Tax Rate: totalTaxRate=gstRate+pstRate

Amount Before Taxes:

amountBeforeTaxes=totalAfterTaxes/(1+totalTaxRate)

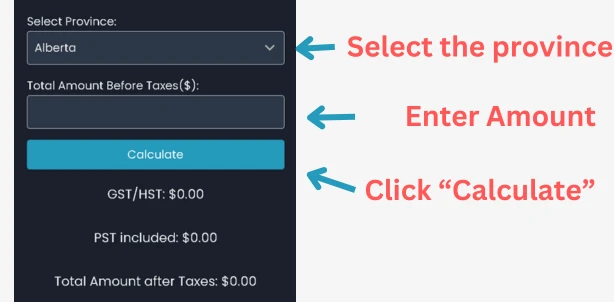

How to use GST/HST Calculator

The following is the purpose of using these calculators:

Steps to use GST Sales Tax Calculator

Select the province from the dropdown menu.

Enter the amount before taxes (in dollars) for which you want to calculate the taxes.

Click the "Calculate" button.

The calculator will display the GST/HST amount, PST amount, and the total amount including taxes.

Steps to use Reverse Sales Tax Calculator

Select the province from the dropdown menu.

Enter the total amount after taxes (in dollars) that includes the taxes on service/product.

Click the "Calculate" button.

The calculator will display the GST/HST amount, PST amount, and the amount before taxes.

Tips to Use Both Calculators

- Please ensure you select the correct province as tax rates vary by province.

- Enter the amount in the correct format.

- Double-check your entries for accuracy to get the correct GST/HST calculations.

FAQS

For Other Information in Canada related to Tax