GST/HST Number Registration and Lookup Online

The process to register for a new GST/HST number for a new business is very easy. You must have a social insurance number to sign up for a GST/HST account in Canada, and you must have filed an income tax return with the CRA. For further details regarding online registration, follow the steps mentioned below to avoid mistakes.

CRA has started the process of registering for a GST/HST number from June 17, 2024, using Business Registration Online. You can perform the steps mentioned below for the GST number lookup process to ensure that your business charging GST/HST is properly registered, which is necessary for validating your claims for input tax credits.

How to get a GST/HST Number Online?

After GST/HST Number registration, businesses must follow GST Payment Dates based on their reporting period to pay collected GST/HST and file returns. Here are the step-by-step guidelines to get registered.

- Click on the “Register GST Number” button below to start the process of business number registration for GST/HST.

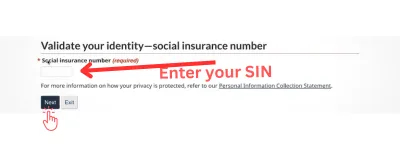

- Enter your “Social Insurance Number” and click “Next.”

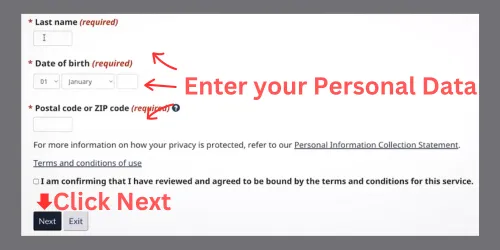

- The next page will prompt you to fill in your personal data.

- Enter your first name, last name, date of birth, and postal address, then click the “Next” button.

- On the next page, you will need to agree to the disclaimer by clicking on the “I agree” button.

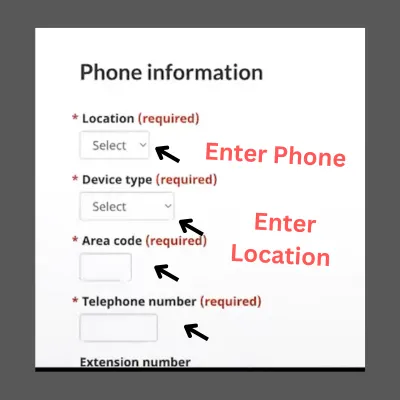

- Next, start the registration process by confirming your identity through location and telephone number, then click “Next.”

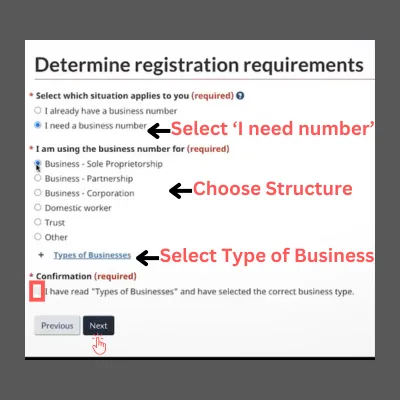

- On this page, you will be asked to determine your registration requirements.

- To generate a new business number, select the “I need a business number” option, which is option 2 in the selection.

- In the next section, choose your business structure from the following options: Sole Proprietorship, Partnership, Corporation, Domestic Worker, Trust, or Other.

- In most cases, Sole Proprietorship is the easiest option to choose, but select the one that best suits your needs.

- After choosing the structure, check the box to confirm that you have read about the types of businesses.

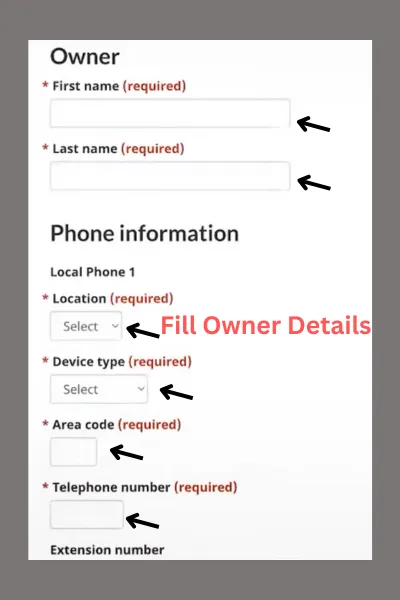

- On the next page, you will be asked to provide the personal data of the owner.

- Fill in the owner’s first name, last name, location, and phone number.

- You can add an international phone number if you operate overseas. Then click the “Next” button.

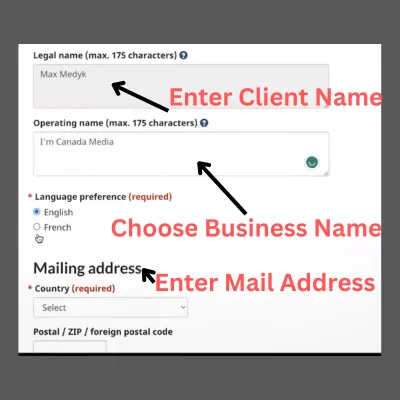

- Select the “Register Client” option and click “Next.”

- You will be asked for the operating name, which will be your business name. Enter your operating name, select the language and country, then fill in your mailing address and click “Next.”

- Once you complete the online registration process, you will receive a confirmation letter in the mail with a code that you will need to enter on the CRA’s Platform for Business Registration.

- After completing the process, CRA will issue a new GST/HST number for your business.

For other Benefit Payment Dates in Canada, read: CCB Payment Dates, CPP Payment Dates

Requirements for Registering a GST/HST Number

The following are the necessary requirements for registering a GST/HST number for your business:

You must have a valid Social Insurance Number (SIN).

Your SIN should not start with a 9.

You must have filed income tax returns.

Note: You must file income tax returns through GST/HST NETFILE.

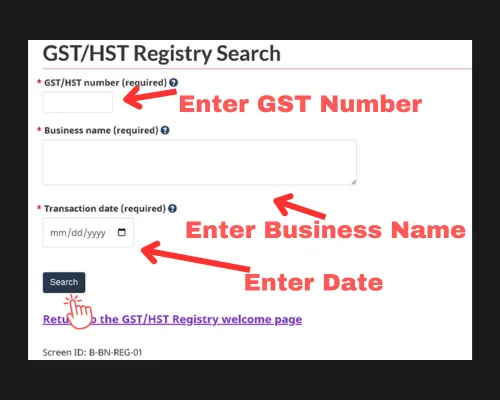

GST/HST Number Lookup Process

Now you can check if your business is correctly registered for claiming input credits using the GST/HST Number Lookup method through the GST/HST registry. Start the process by clicking the button below and follow these step-by-step instructions to confirm:

Requirements for GST/HST Number Lookup

You will need the following information for the GST/HST Lookup:

GST/HST Number

Business Name

Transaction Date

Do not receive my GST my trillium che checks why

please check your status